A perfect storm of behavioral factors gives TurboTax enormous pricing power.

Each year as I do my taxes I am surprised at how eager I am to pay TurboTax anywhere from $59 to $199 to help me file my taxes. A combination of the U.S. tax process in general and TurboTax’s design in particular makes me almost entirely insensitive to price.

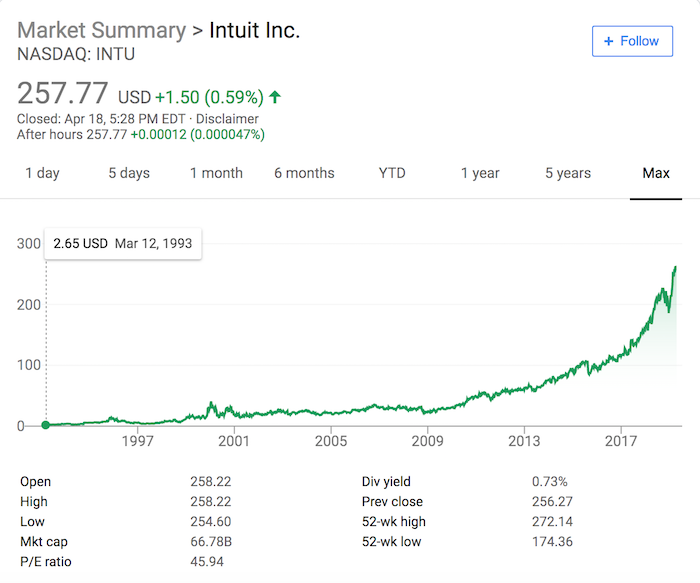

This has led to a great business for TurboTax’s parent company Intuit and has almost definitely led to me overpaying for tax services.

I have been thinking a lot about how willingness to pay differs for the same person situationally and so wanted to explore this more.

Among many other elements, here are the biggest things I think serve to make TurboTax’s customers willing to pay high fees year after year.

The cultural expectation that taxes are hard

Because doing taxes is one of the rare ubiquitous “homework assignments” in American society that everyone does around the same time, it has an outsized reputation as something that is difficult and time consuming.

This expectation primes you with dread for the process of doing your taxes and puts you in the mindset that you need to pay someone for help.

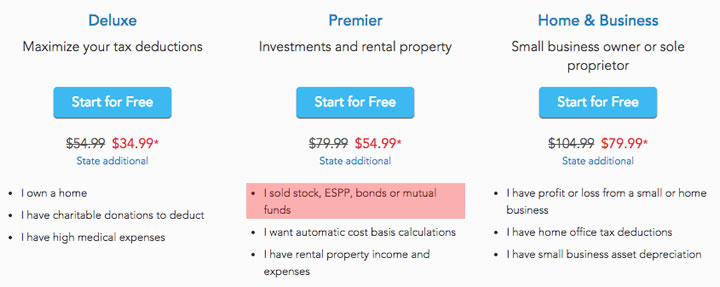

Decision fatigue sets in by the time you choose which package to buy

Decision fatigue is an interesting phenomenon and after doing your taxes you’ve made lots of decisions and probably aren’t terribly confident that you did everything 100% correctly. This depletes the energy you use to make optimal decisions and puts you in a mental state where you’ll agree to most anything to be finished with the process, especially when finishing means a refund.

The way TurboTax is set up, you don’t choose which package to use until the end of the process, when you’re burned out. There are lots of upsells for products like audit protection and state returns. This positions TurboTax perfectly to take advantage of decision fatigue.

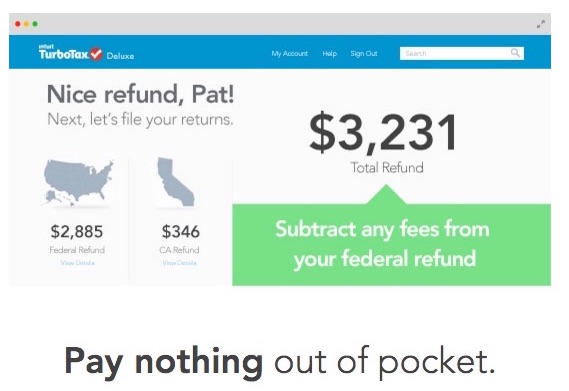

TurboTax shows you your expected refund throughout the process

This really gets the dopamine going, doesn’t it? You can see a number as you are filling out form after form and it becomes a race to realize that refund before it disappears. By the time I was wrapping up my taxes this year, I could feel excitement about my refund clouding my judgment and I clicked through TurboTax’s payment flow quickly and almost definitely sub-optimally.

TurboTax lets you pay directly from your refund

I believe this is the most powerful behavioral factor in the entire process and is an absolute windfall for Intuit. Because the refund money isn’t already in my bank account or budget, it’s much less painful to part with—I’m still netting out way ahead, even if TurboTax takes a $200 cut! Who cares!

Of course, the truth is that 200 dollars is 200 dollars, whether you hand it to someone in cash or have it deducted from your refund. It just feels so much easier to do the latter and it lets TurboTax squeeze customers for fees without churning them out.

Non-Fungibility of money

TurboTax also benefits from the relatively large size of the refund compared to their fees. It is the same phenomenon as the behavioral economics cliché wherein people drive across town for a $10 discount on a $50 blender when they wouldn’t think about exerting that effort for a $10 discount on a $2,000 couch. The payoff for the effort is still $10, but the $10 feels insignificant against the bigger number.

Since a refund is often several thousand dollars, $200 feels comparably insignificant and lets TurboTax continue to charge high fees. The $200 isn’t fungible across situations.

On top of all these factors, TurboTax employs all the usual UI tricks. It nudges you to upgrade by bolding its more expensive options and positioning them as the “default,” it puts giant call-to-action buttons to buy audit protection etc. These tricks have been used ad nauseam by SaaS and e-commerce companies but I expect their effectiveness is multiplied for TurboTax because of all of the behavioral factors I discussed above.

Similar businesses

To me, the most interesting part of TurboTax’s setup is that customers pay straight out of their refund. This feels incredibly powerful to me and I think businesses that can take advantage of this dynamic are attractive. A few industries I’ve thought of where you can do this are:

- Negotiating airline refunds. I know there are companies doing this and I am not sure how viable it is but I know that if a company could reliably get me recompense when a flight was delayed, I would let them keep 40% of it without batting an eye.

- Getting money back from health insurance companies. This is similar to taxes in that it is an opaque process that people hate. It feels like there is room for an agent to help the customer through this process and keep a portion of the money recovered.

- Salary Negotiation. There are lots of 22 year olds each year who get offered jobs paying $70,000 a year and I would bet most of them leave a lot of money on the table by not negotiating those offers up. If an agent could negotiate the offer up 10% to $77k and keep say $4k of that off of the employee’s first year of pay, that feels like a service that lots of people would benefit from and happily pay for.

Thanks for reading. If you’re interested in this sort of thing, sign up below and I’ll email you when I write something new.